Neobanks pilot super-app features for consumers

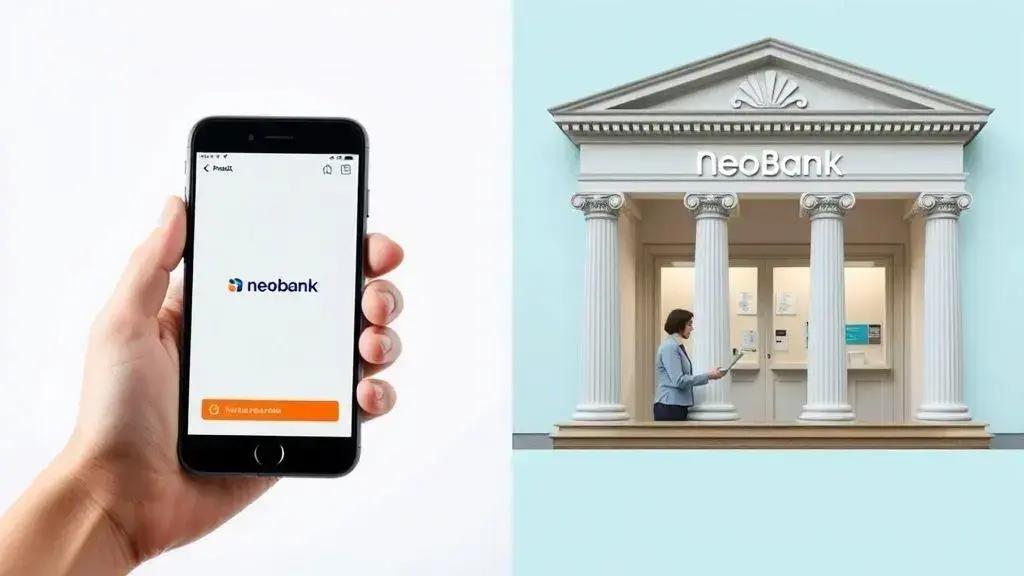

Neobanks are digital-only banks that offer convenient banking services with lower fees, user-friendly apps, and enhanced security, appealing to modern consumers seeking efficient financial management.

Neobanks pilot super-app features for consumers offer a fresh twist on managing money. Have you ever wondered how these digital banks could change your financial experience? Let’s dive in!

What are neobanks?

Neobanks are a new breed of digital banks that operate entirely online. Unlike traditional banks, they do not have physical branches, relying on technology to provide their services.

This model allows neobanks to offer unique features and lower fees, appealing to a tech-savvy audience. Consumers appreciate the ease of access and quick service these banks provide.

Key Characteristics of Neobanks

Neobanks are defined by several important features:

- Mobile-first design: They prioritize mobile applications, making banking accessible on the go.

- Lower fees: Many neobanks offer services with little to no fees, which can save customers money.

- Innovative features: They often include budgeting tools and financial insights to help users manage their money better.

Neobanks attract younger customers who prefer convenient, tech-driven solutions. These digital banks typically focus on streamlined experiences. For example, with simple app interfaces, users can quickly check balances or complete transactions in seconds.

Unlike traditional banks, neobanks often partner with fintech companies to enhance their offerings. This collaboration leads to more tailored financial solutions that meet specific consumer needs. Customers benefit from a wider range of services enhanced by advanced technology. Overall, neobanks represent an innovative shift in how we manage our finances.

Key features of super-apps in neobanks

Super-apps in neobanks are designed to provide a one-stop solution for consumers’ financial needs. These apps combine various services, which creates convenience and efficiency for users.

The features of super-apps serve different banking functions, making them attractive for users who desire seamless financial management. Through innovative technology, neobanks enhance user experiences and satisfaction.

Essential Features of Super-Apps

Here are some key features that set super-apps apart:

- Integrated Services: Users can manage accounts, make payments, and invest all in one place.

- User-Friendly Interface: A simple layout allows users to navigate effortlessly, ensuring a smooth experience.

- Personalized Financial Insights: The app can analyze spending habits and offer recommendations for saving.

- Instant Transactions: Users can send and receive money quickly, enhancing convenience.

Furthermore, these apps often utilize advanced security measures, ensuring that personal information remains safe. By prioritizing user privacy and security, neobanks build trust among their customers.

The idea of having multiple services consolidated into one app is appealing to today’s busy consumers. Whether checking balances, applying for loans, or accessing investment tools, users enjoy the speed and efficiency of a super-app.

Benefits of using neobanks as super-apps

Using neobanks as super-apps presents many advantages that appeal to consumers today. These benefits transform outdated banking experiences into seamless and efficient processes.

One major benefit is convenience. With everything integrated into one app, users can perform multiple banking functions without switching between platforms. From budgeting to payments, all services are accessible with just a few taps.

Cost Savings

Another significant advantage is the potential for cost savings. Neobanks often charge lower fees compared to traditional banks. This can include:

- No monthly fees: Many neobanks waive account maintenance fees.

- Low transaction fees: Users enjoy minimal fees for transfers and withdrawals.

- Competitive interest rates: Some neobanks offer higher interest on savings accounts.

Enhanced user experience is also a key factor driving the popularity of neobanks. The apps are designed with modern users in mind, making them easy to navigate. Features like customized alerts and goal tracking help customers stay on top of their finances.

Moreover, neobanks provide a higher level of security. Users benefit from state-of-the-art technology, ensuring that their personal information remains protected. This builds consumer trust and confidence in the digital banking space.

Lastly, neobanks offer unique financial insights. By analyzing user data, they can provide personalized recommendations, helping users understand spending habits and save more effectively. This ability to adapt and respond to individual needs enhances the overall banking experience.

Comparing neobanks to traditional banking

Comparing neobanks to traditional banking reveals significant differences that cater to modern consumers. Each has its advantages, but neobanks often provide more innovative solutions.

One of the primary distinctions is convenience. Neobanks are entirely online, allowing users to access their services anytime and anywhere. This is a stark contrast to traditional banks, which often require visits to physical branches for certain transactions.

Cost Structure

Cost is another area where neobanks shine. They typically have lower operational costs due to their lack of physical branches. As a result, they can pass these savings onto consumers by offering:

- Lower fees: Many neobanks charge little to no monthly maintenance fees.

- Fewer transaction fees: Users often enjoy reduced costs for money transfers and withdrawals.

- Higher interest rates: Neobanks may provide better rates on savings accounts.

Furthermore, the user experience in neobanks is often enhanced through intuitive app designs. These apps include features that help users manage their finances effectively, from real-time transaction notifications to personalized budgeting tools.

On the downside, traditional banks may offer a sense of security and trust built over many years. Some customers prefer the familiarity of in-person banking and the personal interactions with bank representatives. These interactions can build lasting relationships, which some users value highly.

However, as more consumers seek efficiency, convenience, and cost-effectiveness, neobanks continue to gain traction in the market. They represent a shift toward a digital-first approach to finance, making them an attractive option for tech-savvy users.

In conclusion, neobanks are changing the way we think about banking. Their benefits, including convenience, lower costs, and modern features, make them a great choice for many consumers. While traditional banks offer a sense of familiarity, the rise of digital banking is offering new possibilities for financial management. As technology continues to evolve, neobanks will likely play a significant role in shaping the future of finance.

\n\n\n

\n

\n

FAQ – Frequently Asked Questions about Neobanks

What are neobanks?

Neobanks are digital-only banks that operate online, offering banking services without physical branches.

How do neobanks differ from traditional banks?

Neobanks typically offer lower fees, higher interest rates, and user-friendly apps compared to traditional banks.

Are neobanks safe to use?

Yes, most neobanks utilize advanced security measures to protect customer information and ensure safe transactions.

What services can I find in a neobank super-app?

Neobank super-apps usually include features like budgeting tools, payment options, savings accounts, and personalized financial insights.