Federal Reserve Policies: Impact on Your Savings Accounts

Understanding the new Federal Reserve policies is crucial for predicting the impact on your savings accounts over the next six months, influencing interest rates and purchasing power.

As an American saver, you’re likely wondering how recent shifts in Federal Reserve Policies will affect your hard-earned money. Over the next six months, these policy changes could significantly influence the interest rates on your savings accounts, shaping your financial landscape. This article will delve into the intricacies of these policies and provide actionable insights to help you navigate the evolving economic environment.

The Federal Reserve’s Role in Your Finances

The Federal Reserve, often called the Fed, serves as the central bank of the United States. Its primary mandate involves maintaining price stability, maximizing employment, and ensuring moderate long-term interest rates. These objectives are achieved through various monetary policy tools, which, while seemingly distant, directly influence the economic conditions that dictate the returns on your savings.

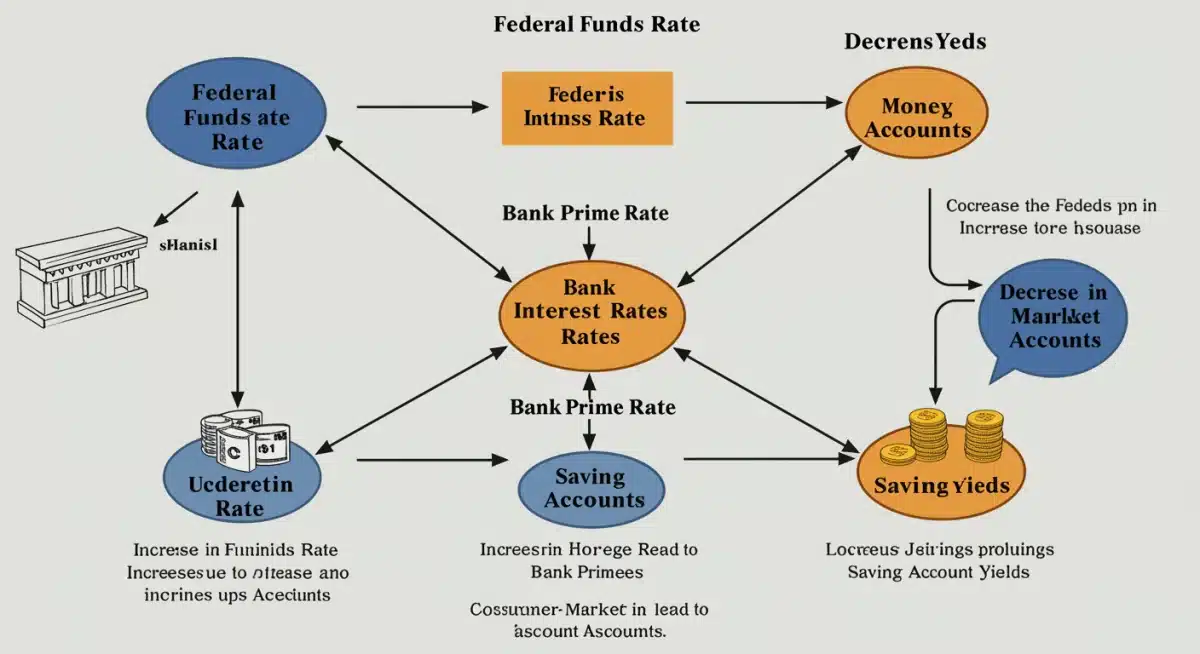

When the Fed adjusts its policies, it creates a ripple effect throughout the financial system. For instance, changes in the federal funds rate – the target rate for interbank lending – directly influence the prime rate, which in turn affects a wide array of consumer and commercial loan rates. This interconnectedness means that even seemingly minor adjustments by the Fed can have a profound impact on your personal financial strategy, especially concerning your savings.

Understanding Monetary Policy Tools

The Fed employs several key tools to manage the economy. Each has a distinct purpose and impacts various aspects of the financial system, ultimately influencing savings account performance.

- Federal Funds Rate: This is the most widely discussed tool, influencing short-term interest rates across the board.

- Quantitative Easing/Tightening: Large-scale asset purchases or sales to inject or withdraw liquidity from the financial system.

- Reserve Requirements: The amount of funds banks must hold in reserve, affecting their lending capacity.

The cumulative effect of these tools determines the overall availability and cost of money in the economy, directly influencing the rates banks offer on savings products. Understanding these mechanisms is the first step toward anticipating how your savings will fare in the coming months.

In essence, the Federal Reserve acts as the conductor of the nation’s economic orchestra, and its decisions resonate through every financial instrument, including your humble savings account. Monitoring their actions provides a crucial lens through which to view your financial future.

Recent Federal Reserve Actions and Their Rationale

In recent periods, the Federal Reserve has taken significant steps to address prevailing economic conditions, primarily inflation and employment levels. These actions are not arbitrary; they are carefully considered responses to economic data, aiming to steer the economy toward stability and sustainable growth. Understanding the motivation behind these decisions is key to comprehending their potential impact on your savings.

The Fed’s decisions are often driven by a dual mandate: achieving maximum employment and stable prices. When inflation rises above the Fed’s target, they typically respond by tightening monetary policy to cool down the economy. Conversely, during periods of economic slowdown or high unemployment, they might ease policy to stimulate growth. These cyclical adjustments are fundamental to their operations.

The Fight Against Inflation

Inflation has been a significant concern, leading the Fed to adopt a more hawkish stance. This involves raising interest rates to curb demand and bring price increases under control.

- Interest Rate Hikes: A primary method to combat inflation, making borrowing more expensive and encouraging saving.

- Quantitative Tightening: Reducing the Fed’s balance sheet to pull liquidity out of the market.

These measures are designed to slow down economic activity, which can eventually lead to lower inflation. However, they also have direct consequences for consumers and their savings. Higher interest rates, while potentially beneficial for savers, can also increase the cost of debt, impacting overall consumer spending.

The rationale behind these actions is to prevent a prolonged period of high inflation, which erodes purchasing power and economic stability. While the immediate effects can feel restrictive, the long-term goal is to preserve the value of the dollar and ensure a healthy economic environment for all.

Direct Impact on Savings Accounts

The most immediate and tangible effect of Federal Reserve policies on your savings accounts is through interest rates. When the Fed raises its benchmark interest rate, banks typically follow suit, offering higher annual percentage yields (APYs) on savings accounts, money market accounts, and certificates of deposit (CDs). This can be a boon for savers, as their money earns more over time without additional effort.

However, the relationship isn’t always one-to-one. Banks consider various factors when setting their rates, including competition, their own funding costs, and their lending demand. While a rising federal funds rate generally translates to higher savings rates, the exact increase can vary significantly between institutions. It’s crucial for consumers to shop around and compare rates to maximize their returns.

What to Expect in the Next Six Months

Forecasting the exact movement of interest rates is challenging, but current economic indicators and Fed communications provide strong clues. If inflation remains elevated, further rate hikes are plausible, potentially leading to even higher APYs on savings products.

Conversely, if inflation shows signs of cooling and unemployment begins to rise, the Fed might pause or even reverse its rate hikes, which could lead to a plateau or slight decrease in savings rates. Staying informed about economic news and Fed announcements is essential for anticipating these shifts.

The next six months will be a dynamic period for savers. While higher rates offer an opportunity to grow your wealth, it’s also important to consider the broader economic context, including inflation’s ongoing erosion of purchasing power. The net effect on your real savings – what your money can actually buy – is the ultimate measure of impact.

Indirect Effects: Inflation and Purchasing Power

While higher interest rates on savings accounts might seem like an unmitigated win for savers, it’s essential to consider the broader economic context, particularly the impact of inflation. The Federal Reserve’s primary goal in raising rates is often to combat inflation, which erodes the purchasing power of your money. Even if your savings account earns a higher interest rate, if inflation is even higher, your real return is negative, meaning your money buys less than it did before.

This concept of ‘real return’ is critical for understanding the true value of your savings. For example, if your savings account yields 3% APY but inflation is running at 5%, your actual purchasing power has decreased by 2%. The Fed aims to bring inflation down to its target of 2%, which would mean that a 3% savings rate would provide a positive real return, allowing your money to grow beyond just keeping pace with price increases.

Understanding Real vs. Nominal Returns

The distinction between nominal and real returns is vital for any saver. Nominal return is the stated interest rate on your account, while real return accounts for inflation.

- Nominal Return: The percentage increase in your savings balance.

- Inflation Rate: The rate at which the general level of prices for goods and services is rising.

- Real Return: Nominal Return – Inflation Rate. This indicates the actual growth in your purchasing power.

Therefore, even with potentially higher nominal interest rates on savings accounts due to Federal Reserve policies, it’s paramount to track the inflation rate. If inflation remains stubbornly high, the benefit of increased interest earnings could be significantly diminished. The Fed’s actions are a balancing act, trying to cool inflation without tipping the economy into a deep recession, a balance that directly affects your financial well-being.

Ultimately, the true measure of your savings’ performance isn’t just the number printed on your statement, but what that number can actually purchase. Federal Reserve policies are constantly trying to optimize this balance, making it a continuous task for savers to stay informed and adapt.

Strategies for Savers in the Current Climate

Given the dynamic nature of Federal Reserve policies and their impact on interest rates and inflation, savers need to adopt proactive strategies to optimize their financial outcomes. Simply letting money sit in a traditional savings account without actively monitoring the rates might mean missing out on significant opportunities or, worse, losing purchasing power due to inflation.

One of the most effective strategies is to be an informed consumer. Regularly check the APY offered by various financial institutions. Online banks, in particular, often offer higher interest rates on savings accounts and money market accounts compared to traditional brick-and-mortar banks, as they have lower overhead costs. Don’t be afraid to switch banks if a better offer arises, especially for your emergency fund or short-term savings.

Exploring Higher-Yield Options

Beyond standard savings accounts, other options might offer better returns, especially in a rising interest rate environment. These alternatives come with varying degrees of liquidity and risk.

- High-Yield Savings Accounts: Often found at online banks, these offer significantly better APYs than traditional accounts.

- Money Market Accounts (MMAs): Similar to savings accounts but often with check-writing capabilities and slightly higher rates.

- Certificates of Deposit (CDs): Offer fixed interest rates for a set term. Longer terms typically yield higher rates, but money is locked in.

For those comfortable with slightly less liquidity, laddering CDs can be a smart strategy. This involves investing in CDs with staggered maturity dates (e.g., a 3-month, 6-month, and 12-month CD). As each CD matures, you can reinvest the funds into a new, longer-term CD, capturing potentially higher rates if they continue to rise, while still having access to some funds periodically.

Diversifying your savings across different types of accounts based on your liquidity needs and risk tolerance is also a prudent approach. While the Federal Reserve sets the stage, it’s up to individual savers to make the most of the prevailing economic conditions.

Looking Ahead: What to Monitor in the Next 6 Months

The next six months will be pivotal in determining the trajectory of Federal Reserve policies and their subsequent impact on your savings accounts. Staying informed and knowing what key indicators to watch will empower you to make timely and effective financial decisions. The Fed’s decisions are rarely made in isolation; they are a response to a complex interplay of economic data and global events.

One of the most crucial things to monitor is the inflation rate, particularly the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, which is the Fed’s preferred measure. A sustained decrease in these indicators could signal a potential pause or even a shift in the Fed’s hawkish stance. Conversely, persistent high inflation might necessitate further tightening.

Key Economic Indicators to Watch

Several economic reports provide insights into the Fed’s likely next moves. Keeping an eye on these can help you anticipate changes in savings rates.

- Inflation Reports (CPI, PCE): Direct measures of price changes.

- Employment Data (Jobs Report, Unemployment Rate): Reflects the health of the labor market, a key Fed mandate.

- GDP Growth: Indicates overall economic activity and potential for recession.

- Fed’s FOMC Statements: Official communications from the Federal Open Market Committee provide direct insight into their thinking and future plans.

Beyond economic data, pay close attention to the Federal Open Market Committee (FOMC) meetings and the press conferences held by the Fed Chair. These events often provide forward guidance on monetary policy, signaling potential rate changes. Market reactions to these announcements can also offer clues about investor sentiment and expectations for future rates.

By diligently monitoring these factors, you can better position your savings to adapt to the evolving economic landscape. Proactive engagement with financial news, rather than passive observation, will be your greatest asset in the coming months.

| Key Aspect | Impact on Savings |

|---|---|

| Federal Funds Rate | Directly influences bank interest rates, potentially increasing APYs. |

| Inflation Trends | Erodes purchasing power; high inflation can lead to negative real returns. |

| Monetary Tightening | Aims to cool economy, potentially increasing savings rates but also cost of debt. |

| Economic Outlook | Future Fed actions depend on employment, GDP, and global stability, affecting rates. |

Frequently Asked Questions About Fed Policies and Savings

Federal Reserve rate hikes typically lead banks to increase the Annual Percentage Yield (APY) on savings accounts. This happens because the cost of borrowing for banks also rises, making them more competitive to attract deposits. However, the exact increase can vary by institution.

Nominal return is the stated interest rate your savings account earns. Real return, however, is the nominal return adjusted for inflation. If inflation is higher than your nominal return, your real purchasing power decreases, even if your account balance grows.

In a rising interest rate environment, moving savings to a high-yield account, often offered by online banks, can significantly boost your earnings. These accounts typically offer much better APYs compared to traditional savings accounts, maximizing your returns amidst Federal Reserve policy changes.

While higher interest rates generate more money, high inflation can erode your purchasing power. If the rate of inflation exceeds your savings account’s APY, the real value of your money diminishes over time. The Fed aims to control inflation to preserve your savings’ value.

Key indicators include inflation reports (CPI, PCE), employment data (jobs reports), and GDP growth. Monitoring these, along with official FOMC statements, provides valuable insight into the Federal Reserve’s likely next steps and their potential impact on savings account rates.

Conclusion

As we’ve explored, Federal Reserve Policies exert a profound and multifaceted influence on your savings accounts, particularly over the next six months. While higher interest rates can offer a welcome boost to your earnings, it’s crucial to consider the persistent challenge of inflation, which can diminish your real purchasing power. Staying informed about the Fed’s actions, understanding key economic indicators, and proactively seeking out the best savings vehicles are essential strategies for navigating this evolving financial landscape. By doing so, you can better position your savings to grow and maintain their value, securing your financial well-being in the face of ongoing economic shifts.