ACA Subsidies 2025: Estimate Savings & Secure Coverage

The Affordable Care Act (ACA) subsidies in 2025 provide crucial financial assistance for Americans to afford health insurance, with eligibility and amounts depending on household income and family size, making coverage accessible before the December 15 deadline.

Understanding the intricacies of Affordable Care Act (ACA) subsidies in 2025 is paramount for millions of Americans seeking affordable health coverage. As the December 15 deadline approaches, knowing how to estimate your potential savings can significantly impact your financial well-being and access to essential healthcare services.

deciphering ACA subsidies for 2025

The Affordable Care Act (ACA), often referred to as Obamacare, was enacted to make health insurance more accessible and affordable for Americans. A cornerstone of this legislation is the provision of financial assistance, known as subsidies, which help lower monthly premium costs and out-of-pocket expenses. For 2025, these subsidies continue to play a vital role in ensuring that health coverage remains within reach for individuals and families across various income brackets.

These subsidies are primarily available through the Health Insurance Marketplace (also known as the Exchange) and are designed to reduce the financial burden of health insurance premiums. The amount of assistance an individual or family receives is directly tied to their household income relative to the federal poverty level (FPL), as well as their family size. Understanding these foundational elements is the first step toward estimating your potential savings and navigating the enrollment process effectively.

how premium tax credits work

Premium Tax Credits (PTCs) are the most common form of ACA subsidy. These credits can be used to lower your monthly health insurance premiums directly. When you apply for coverage through the Marketplace, you can choose to have these credits paid directly to your insurance company, reducing your upfront costs. Alternatively, you can pay the full premium each month and claim the entire credit when you file your federal income tax return.

- Income-Based Assistance: PTCs are calculated on a sliding scale, meaning those with lower incomes generally receive more significant subsidies.

- Benchmark Plan: The subsidy amount is tied to the cost of the second-lowest-cost Silver plan available in your area.

- Advance Payments: Most people opt for advance payments of the PTC to reduce their monthly premiums immediately.

cost-sharing reductions explained

Beyond premium assistance, some individuals and families may also qualify for Cost-Sharing Reductions (CSRs). These subsidies help lower the out-of-pocket costs associated with healthcare, such as deductibles, co-payments, and co-insurance. Unlike Premium Tax Credits, CSRs are only available if you enroll in a Silver-level plan through the Marketplace. They directly reduce the amount you pay when you receive medical care.

It’s important to note that while PTCs can be applied to any metal-level plan (Bronze, Silver, Gold, Platinum), CSRs are exclusive to Silver plans. This distinction is crucial when choosing a plan, as a Silver plan with CSRs can offer significantly better value than a higher-tier plan without such reductions for eligible individuals. The combination of PTCs and CSRs can make high-quality healthcare remarkably affordable.

In essence, ACA subsidies represent a critical lifeline for many, making health insurance not just a possibility, but a tangible reality. The system is designed to prevent individuals from paying an excessive percentage of their income towards premiums, ensuring that health coverage is a right, not a luxury.

eligibility criteria for 2025 ACA subsidies

Determining your eligibility for ACA subsidies in 2025 involves several key factors. The primary determinants are your household income, family size, and whether you have access to other affordable health coverage, such as through an employer or government programs. The federal poverty level (FPL) serves as a crucial benchmark in these calculations, with subsidy eligibility extending to individuals and families earning up to 400% of the FPL.

For 2025, the income thresholds are adjusted annually, so it’s essential to use the most current FPL guidelines. Generally, if your household income falls within 100% and 400% of the FPL, you are likely to qualify for premium tax credits. However, recent legislative changes have temporarily expanded eligibility, removing the upper income limit for subsidy eligibility, effectively ensuring that no one pays more than 8.5% of their household income for a benchmark plan.

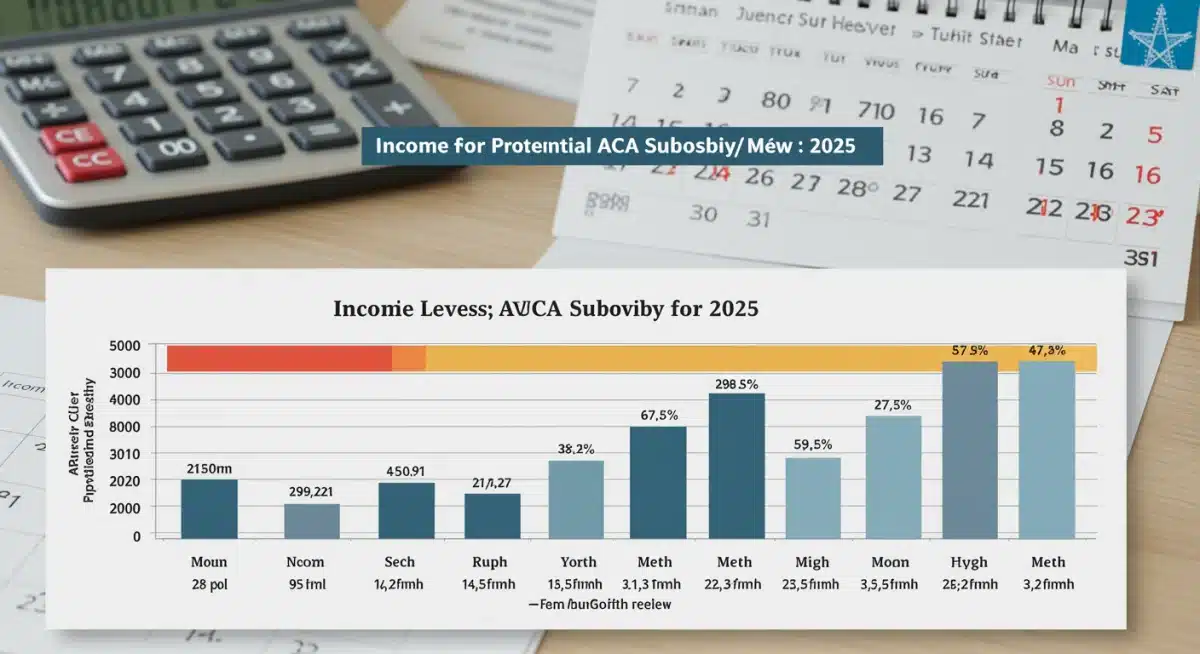

income thresholds and federal poverty level

The Federal Poverty Level (FPL) is a set of income thresholds used by the federal government to determine eligibility for various programs. For ACA subsidies, your Modified Adjusted Gross Income (MAGI) is compared to the FPL for your household size. As an example, for a single individual in 2024, 100% FPL was around $14,580, and 400% FPL was approximately $58,320. These figures will be updated for 2025, and it’s important to consult the official Marketplace website or a certified assister for the most accurate numbers.

The expanded eligibility, which aims to cap premium contributions at 8.5% of income, is a significant change. This means that even if your income is above 400% FPL, you might still qualify for subsidies if the cost of the benchmark plan exceeds 8.5% of your MAGI. This provision has made health insurance more affordable for a broader range of middle-income households.

other eligibility considerations

- Citizenship/Immigration Status: You must be a U.S. citizen, U.S. national, or lawfully present immigrant.

- Incarceration Status: Incarcerated individuals are generally not eligible for Marketplace plans or subsidies.

- Access to Employer Coverage: If you have access to affordable, minimum value health coverage through an employer, you typically won’t qualify for Marketplace subsidies. Employer-sponsored coverage is considered affordable if the employee’s share of the premium for self-only coverage is less than a certain percentage of household income (adjusted annually).

- Medicaid/CHIP Eligibility: If you qualify for Medicaid or the Children’s Health Insurance Program (CHIP), you won’t be eligible for Marketplace subsidies.

It is crucial to accurately report all relevant information when applying through the Marketplace. Providing precise details about your income, household, and access to other coverage ensures that you receive the correct amount of financial assistance and avoid potential issues during tax season.

estimating your 2025 ACA subsidy savings

Estimating your potential ACA subsidy savings for 2025 can seem complex, but with the right tools and information, it becomes much clearer. The primary goal is to determine how much of your monthly premium will be covered by the Premium Tax Credit. This estimation relies heavily on your projected household income for the coverage year, your family size, and the cost of the benchmark plan in your specific geographic area.

The Health Insurance Marketplace website provides calculators and comparison tools that are invaluable for this process. By inputting your expected income, household members, and zip code, these tools can offer a personalized estimate of your subsidy eligibility and the amount you might receive. It’s important to remember that these are estimates, and actual amounts may vary slightly based on final plan selections and income verification.

using the marketplace calculator

The official HealthCare.gov website (or your state’s Marketplace if applicable) offers a user-friendly subsidy calculator. This tool is designed to provide a realistic projection of your costs and savings. To get the most accurate estimate, you’ll need:

- Projected 2025 Household Income: This includes wages, salaries, self-employment income, Social Security benefits, and certain other taxable income for all members of your tax household.

- Household Size: The number of people you claim on your tax return, including yourself, your spouse, and any tax dependents.

- Your Zip Code: This helps the calculator identify the benchmark plans and their costs in your service area.

Once you input this information, the calculator will display estimated monthly premiums for various plans, factoring in your potential Premium Tax Credit. It will also indicate if you might qualify for Cost-Sharing Reductions.

factors affecting your subsidy amount

Several variables can influence the exact amount of subsidy you receive:

- Changes in Income: If your income changes significantly throughout 2025, you must update the Marketplace to adjust your subsidy. Failing to do so could result in owing money back at tax time or receiving less assistance than you’re entitled to.

- Household Changes: Marriage, divorce, birth or adoption of a child, or a dependent leaving the household can all impact your subsidy.

- Benchmark Plan Costs: The cost of the second-lowest-cost Silver plan in your area can fluctuate annually, which directly affects the calculation of your Premium Tax Credit.

By diligently using the Marketplace’s resources and keeping your information updated, you can confidently estimate your 2025 ACA subsidy savings and make informed decisions about your health coverage. This proactive approach ensures you maximize your financial assistance and secure the best plan for your needs.

navigating the marketplace and enrollment process

Securing health coverage through the Health Insurance Marketplace involves a structured enrollment process, especially when utilizing ACA subsidies. The process is designed to be user-friendly, guiding you from application to plan selection. Understanding each step can help you avoid common pitfalls and ensure you enroll in a plan that best fits your healthcare needs and budget before the December 15 deadline.

The Marketplace consolidates various health plans from different insurance companies, allowing for easy comparison. This centralized platform is where you will apply for financial assistance, compare plans, and ultimately enroll. It’s crucial to initiate this process well before the deadline to allow ample time for questions, document submission, and any potential troubleshooting.

key steps for enrollment

- Create an Account: Start by creating an account on HealthCare.gov or your state’s Marketplace website.

- Complete the Application: Provide detailed information about your household, income, and any existing health coverage. This information is used to determine your eligibility for subsidies.

- Review Eligibility Results: After submitting your application, you will receive an eligibility determination, indicating whether you qualify for Premium Tax Credits and/or Cost-Sharing Reductions.

- Compare Plans: Browse available plans, comparing premiums, deductibles, out-of-pocket maximums, and covered services. Pay close attention to metal levels (Bronze, Silver, Gold, Platinum) and network types (HMO, PPO, EPO, POS).

- Enroll in a Plan: Once you’ve selected a plan, complete the enrollment process through the Marketplace. You will typically need to make your first premium payment directly to the insurance company.

important dates and deadlines

Open Enrollment is the annual period when you can sign up for a new health plan or change your existing one through the Marketplace. For 2025 coverage, the primary deadline to secure coverage starting January 1st is typically December 15th. Missing this deadline means your coverage might start later, or you may need to wait for a Special Enrollment Period (SEP).

Special Enrollment Periods are available outside of Open Enrollment if you experience certain qualifying life events, such as marriage, birth of a child, loss of other health coverage, or moving to a new area. These periods allow you to enroll in or change a plan even after the general deadline. However, it’s always best to enroll during Open Enrollment if possible to ensure continuous coverage.

Successful navigation of the Marketplace requires attention to detail and timely action. By understanding the enrollment steps and adhering to deadlines, you can effectively secure the health coverage you need with the benefit of ACA subsidies.

maximizing your savings with ACA subsidies

Beyond simply qualifying for ACA subsidies, there are strategies you can employ to maximize your savings and ensure you’re getting the most value from your health insurance plan. This involves a careful consideration of plan types, understanding how subsidies interact with different metal levels, and proactively managing your Marketplace account.

The goal is not just to find a plan, but to find the most cost-effective plan that also meets your healthcare needs. This often means looking beyond just the monthly premium and considering the total out-of-pocket costs, including deductibles, co-payments, and co-insurance, especially if you anticipate needing significant medical care throughout the year.

choosing the right metal level plan

The Marketplace offers plans categorized into metal levels: Bronze, Silver, Gold, and Platinum. Each level represents a different balance between monthly premiums and out-of-pocket costs:

- Bronze: Lowest monthly premiums, highest out-of-pocket costs (deductibles). Best for those who rarely visit the doctor.

- Silver: Moderate premiums and out-of-pocket costs. Crucially, Silver plans are the only ones eligible for Cost-Sharing Reductions (CSRs) if you qualify.

- Gold: Higher monthly premiums, lower out-of-pocket costs. Good for those who expect to use a lot of medical services.

- Platinum: Highest monthly premiums, lowest out-of-pocket costs. Offers comprehensive coverage with minimal financial exposure.

If you qualify for Cost-Sharing Reductions, a Silver plan often provides the best value. The CSRs can significantly lower your deductibles and co-pays, making a Silver plan with CSRs more comprehensive and affordable than a Gold or even Platinum plan for eligible individuals.

updating your information proactively

Your subsidy amount is based on your projected annual income. If your income or household size changes during the year, it is vital to update this information on your Marketplace account as soon as possible. Failure to do so can lead to an incorrect subsidy amount:

- Under-subsidized: You might receive less financial help than you’re entitled to, leading to higher monthly premium payments than necessary.

- Over-subsidized: You might receive too much financial help, which you would then have to repay at tax time.

Being proactive about updating your information ensures that your subsidies are accurately adjusted, helping you maximize your savings throughout the year and avoid any unexpected tax liabilities. Regularly reviewing your Marketplace account and understanding your plan’s benefits are key steps to optimizing your healthcare expenses.

common pitfalls and how to avoid them

While ACA subsidies offer significant financial relief, navigating the system isn’t without its potential challenges. Being aware of common pitfalls can help you avoid mistakes that might lead to incorrect subsidy amounts, coverage gaps, or unexpected costs. Proactive planning and attention to detail are your best allies in securing and maintaining affordable health coverage.

Many issues stem from misunderstandings about income reporting or neglecting to update personal information. By taking a few preventative measures, you can ensure a smoother experience with your ACA plan and subsidies.

incorrect income estimation

One of the most frequent issues is misestimating your household income for the coverage year. Your ACA subsidy is based on your projected Modified Adjusted Gross Income (MAGI). If your actual income at the end of the year differs significantly from your estimate, it can impact your tax return:

- Underestimating Income: If you estimate your income to be lower than it actually is, you might receive more in advance premium tax credits than you are eligible for. This could result in owing money back to the IRS when you file your taxes.

- Overestimating Income: If you estimate your income to be higher than it actually is, you might receive less in advance premium tax credits. While this means you could receive a refund when you file taxes, you would have paid higher monthly premiums throughout the year than necessary.

To avoid this, try to make the most accurate income projection possible. If your income changes during the year, update your Marketplace application immediately.

missing enrollment deadlines

The annual Open Enrollment Period is specific, and missing the December 15 deadline for January 1st coverage can have significant consequences. If you miss Open Enrollment, you might not be able to get health insurance through the Marketplace until the next year, unless you qualify for a Special Enrollment Period (SEP).

SEPs are triggered by specific life events, such as losing other health coverage, getting married, having a baby, or moving. Relying on an SEP can be risky, as not all life events qualify, and there are strict timelines for applying once an event occurs. Always aim to enroll during Open Enrollment to ensure continuous coverage.

Avoiding these common pitfalls requires vigilance and a clear understanding of the Marketplace rules. By accurately reporting your income, staying informed about deadlines, and proactively updating your information, you can ensure your ACA subsidies work effectively for you.

securing coverage before december 15

The December 15th deadline is not just another date on the calendar; it’s a critical cutoff for ensuring uninterrupted health coverage starting January 1st of the new year. For those relying on ACA subsidies, meeting this deadline is essential to lock in your financial assistance and avoid any gaps in healthcare access. Procrastination can lead to unnecessary stress and potentially higher costs.

Planning ahead and gathering all necessary documentation can streamline your application process. The Marketplace can become very busy closer to the deadline, so starting early provides a buffer for any unforeseen issues or questions that may arise.

the importance of timely enrollment

Enrolling by December 15th ensures that your chosen health plan is active from the very first day of the new year. This means you will have continuous coverage for any medical needs that may arise. Missing this deadline typically means your coverage start date will be delayed, potentially to February 1st or even later, depending on when you finally enroll.

A gap in coverage, even for a month, can be financially risky. Unexpected medical emergencies or ongoing health conditions could lead to significant out-of-pocket expenses if you are uninsured. Therefore, prioritizing the December 15th deadline is a fundamental step in responsible health planning.

checklist for december 15 deadline

To prepare for enrollment and ensure you meet the deadline, consider the following checklist:

- Gather Required Documents: Have your Social Security numbers, income information (pay stubs, W-2s, tax returns), and any existing health insurance policy numbers ready.

- Estimate 2025 Income: Accurately project your household’s Modified Adjusted Gross Income (MAGI) for the upcoming year.

- Review Household Changes: Account for any changes in family size (marriages, births, divorces) that will occur in 2025.

- Compare Plans Carefully: Don’t just look at premiums. Consider deductibles, co-pays, prescription drug coverage, and whether your preferred doctors are in-network.

- Confirm Enrollment: After selecting a plan, ensure you complete all steps to formally enroll and make your first premium payment if required by your insurer.

By diligently following these steps and respecting the December 15th deadline, you can confidently secure your ACA-subsidized health coverage for 2025, providing peace of mind and access to essential healthcare services.

resources and support for ACA enrollment

Navigating the complexities of the Affordable Care Act and its subsidies can sometimes require assistance. Fortunately, a robust network of resources and support channels is available to help you understand your options, estimate your savings, and complete the enrollment process. These resources are designed to ensure that everyone has the opportunity to secure affordable health coverage.

Whether you prefer self-service online tools or personalized guidance, there are avenues to get the help you need. Utilizing these resources can clarify any doubts and ensure a smooth and accurate enrollment experience.

official marketplace websites and tools

The primary resource for all things ACA is the official Health Insurance Marketplace website, HealthCare.gov. For states that run their own marketplaces, you will access their dedicated websites (e.g., Covered California, NY State of Health). These platforms offer:

- Plan Comparison Tools: Allowing you to filter and compare plans based on cost, benefits, and provider networks.

- Subsidy Calculators: Providing estimates of your potential Premium Tax Credits and Cost-Sharing Reductions.

- Detailed Information: Comprehensive guides, FAQs, and explanations of ACA rules and benefits.

These online tools are regularly updated with the latest information for the upcoming coverage year, making them essential for self-guided enrollment.

finding local assistance

For those who prefer face-to-face assistance or have more complex situations, there are trained professionals available:

- Navigators: These individuals and organizations are funded by the federal government to provide free, unbiased help to consumers. They can assist with applications, plan comparisons, and enrollment.

- Certified Application Counselors (CACs): Similar to Navigators, CACs work for organizations that assist individuals with Marketplace enrollment.

- Insurance Agents and Brokers: Licensed agents and brokers can also help you enroll in a Marketplace plan. While their services are typically free to you (they are compensated by insurance companies), they may have affiliations with specific insurers.

You can find local assistance by searching on HealthCare.gov or your state’s Marketplace website using your zip code. These professionals can be particularly helpful for understanding specific plan details, network restrictions, and how certain medical conditions might affect your choices.

Remember, you don’t have to navigate the ACA enrollment process alone. Leveraging the available resources and support can empower you to make informed decisions and secure the best possible health coverage for 2025.

| Key Aspect | Brief Description |

|---|---|

| Eligibility | Based on household income (MAGI) relative to Federal Poverty Level (FPL) and family size. |

| Subsidy Types | Premium Tax Credits (PTCs) reduce monthly premiums; Cost-Sharing Reductions (CSRs) lower out-of-pocket costs on Silver plans. |

| Estimation Tools | Use HealthCare.gov’s calculator with projected income, family size, and zip code for accurate savings estimates. |

| Key Deadline | Enroll by December 15 for coverage starting January 1, 2025, to avoid gaps. |

frequently asked questions about ACA subsidies

ACA subsidies are designed to make health insurance more affordable by reducing monthly premiums and out-of-pocket costs for eligible individuals and families. They help ensure access to essential healthcare services by lowering the financial burden of coverage.

Eligibility is primarily based on your projected household income for 2025 relative to the Federal Poverty Level (FPL) and your family size. You can use the HealthCare.gov calculator to get a personalized estimate of your qualification.

Premium Tax Credits (PTCs) lower your monthly health insurance premiums. Cost-Sharing Reductions (CSRs) reduce your out-of-pocket expenses like deductibles and co-pays, but are only available with Silver-level plans.

You must update the Marketplace immediately if your income changes significantly. This ensures your subsidy amount is adjusted correctly, preventing you from owing money back at tax time or missing out on additional assistance.

Enrolling by December 15 ensures your health coverage begins on January 1, 2025. Missing this deadline could result in a delay in your coverage start date or a gap in insurance, leaving you exposed to unexpected medical costs.

conclusion

Navigating the landscape of Affordable Care Act (ACA) subsidies in 2025 is a critical step for securing affordable health coverage. By understanding the eligibility criteria, utilizing available estimation tools, and adhering to the December 15 deadline, individuals and families can effectively estimate their savings and enroll in a plan that meets their needs. The ACA’s financial assistance remains a vital component of accessible healthcare, empowering millions to obtain quality insurance and maintain their well-being. Proactive engagement with the Marketplace and its resources ensures that you can maximize your benefits and secure continuous, affordable coverage for the upcoming year.